Trade Idea: Another Trump-Putin Meeting in 2025?

Market: Trump-Putin meeting again by…

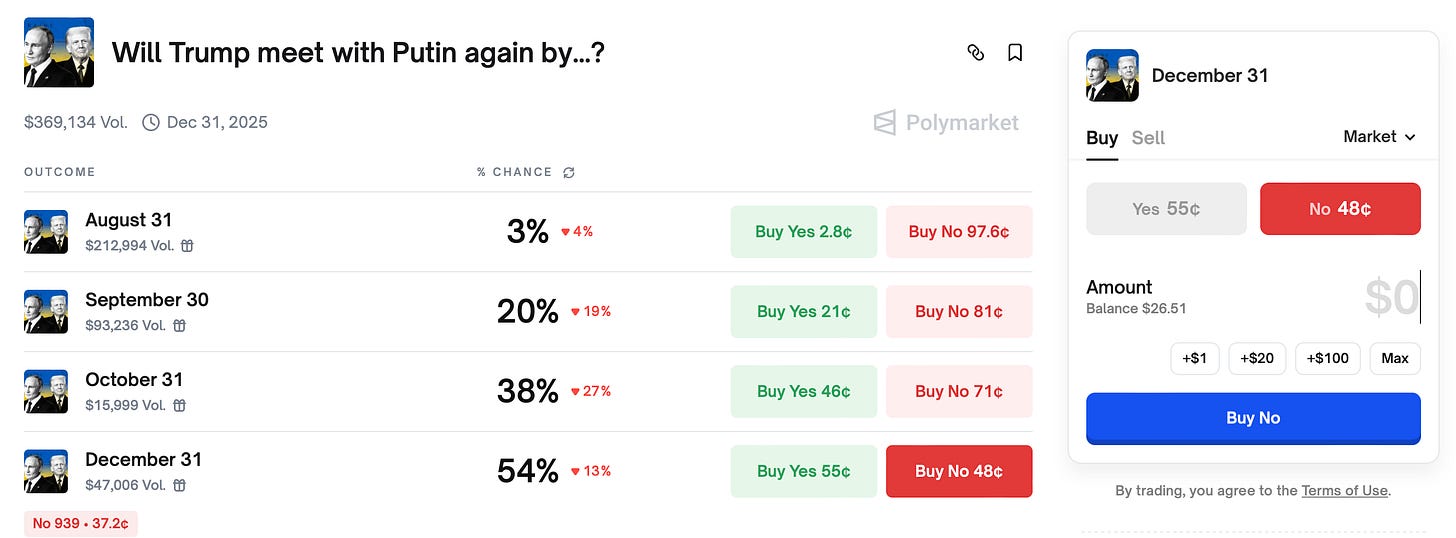

Trade: December 31 - No

Current Odds: 48%

Potential Return: 108%

Resolved by: End of 2025

Position Size: Medium

Welcome back to The Poly. Today we are looking at a market that has popped up with regard to another Trump meeting with Putin in 2025. We think the pricing is wrong on this one and believe it deserves a serious look.

Why Trump is Unlikely to Meet Putin Again in 2025

Polymarket traders currently give a 54% chance that Donald Trump will meet Vladimir Putin again before the end of 2025. But history, geopolitics, and incentives suggest those odds are far too high. In reality, the barriers to a near-term summit are significant, making “No” the smarter side of this bet. At 48¢, we think the “No” contract offers the best value for a number of reasons.

1. Past Frequency of Putin Meetings

Trump’s first term in office offers a useful baseline. Despite four years of constant speculation about his relationship with Putin, formal, in-person meetings were rare:

July 2018 (Helsinki Summit) — the only full bilateral summit.

July 2017 (Hamburg G20) — brief meeting on the sidelines.

November 2017 (APEC Vietnam) — informal interaction.

Other years — little more than fleeting encounters at multilateral events.

In short, a handful of meetings in four years.

Crucially, since Russia invaded Ukraine, meetings between Putin and Western leaders have become even more scarce. While Putin had several meetings with Western leaders in the run up to the invasion, his meetings since then have largely been with more authoritarian leaders such as China’s Xi Jinping, Belarus’ Alexander Lukashenko and Turkey’s Recep Erdoğan. In fact, by our reckoning, the recent summit in Alaska provides the first meeting with a Western leader since the 2022 invasion.

Generally speaking, meetings of this type take a lot of preparation and back and forth. If history is any guide, the idea of a second meeting between Trump and Putin being squeezed in before 2026 seems like a tall order. We think the probability is much closer to 25-30% than the 54% being offered.

2. Putin’s Incentives: No Real Interest in Peace

Markets may also be misreading Russia’s signalling and Putin’s interest in actually ending the war. Just today, the Financial Times reported that Putin has floated the idea of “security guarantees” involving Russia, the U.S., China, the UK, and France — but this is more diplomatic theater than genuine negotiation and it’s an indication that Russia has no intention of peace. If security guarantees need to be approved by Russia, then they are essentially meaningless. This is clearly something that Ukraine and Europe will have no interest in.

Veto power demand: Russia insists on terms that effectively give Moscow a veto over Western defense commitments to Ukraine. This is a non-starter for Kyiv and Washington alike.

Strategic benefit of war: Putin benefits from keeping the conflict alive — it destabilizes NATO, drains Western resources, and cements his domestic grip on power. A real peace deal would weaken his narrative at home.

Bluffing tactic: Floating the possibility of talks helps Russia look reasonable while shifting blame onto the West when nothing materializes.

In this context, Putin has little incentive to rush into a meeting with Trump that would force him to show flexibility. The idea that Putin is in a hurry to step up negotiations and bring an end to the war seems more like one of Trump’s fantasies. Putin, in our view, is more likely to do what he can to delay the peace process and it is easy to imagine those delays stretching on for weeks and months. Certainly, the more delays we see, the more opportuntiy there will be to exit this market with a profitable trade.

Market Mispricing

Right now, the Polymarket curve shows:

August 31: 3%

September 30: 20%

October 31: 38%

December 31: 54%

We like the look of both the October 31-No and December 31-No markets here. (There is also a market on a meeting between Zelensky and Putin that looks interesting).

Conclusion

Based on history, Trump-Putin meetings occur less than once per year, and usually after a long buildup. Moreover, since the war, meetings with Western leaders have been non-existent. When you couple this with Putin’s likely incentives, the odds of a second 2025 summit seem much lower than 54%. Hence the 48¢ market for “No” offers asymmetric value. As is often the case, the market appears to be overpricing headlines and underpricing historical precedent and geopolitical incentives.

Thank you for reading The Poly, the #1 newsletter for prediction markets.

If you enjoyed this analysis, please help us by clicking the “♡ Like” button.

Risk warning and disclaimer: The Poly Newsletter is for information and entertainment purposes only and should not be regarded as investment advice. Betting on prediction markets is high risk and can result in significant financial loss. Professional bettors typically risk no more than 0.5-2% of their capital on any one trade. No warranty is made to the accuracy, completeness or correctness of the information provided. The information in the publication may become outdated and there is no obligation to update any such information. Never bet more than you can afford to lose.