Trade Idea: Kanye launching a crypto coin

Market: Will Kanye launch a coin in February?

Return: 1,000% - High-risk (resolved by Friday)

Welcome back to The Poly. Our last idea on Nvidia becoming the largest company in the world is still in play today, with earnings coming in above estimates last night. Unfortunately, we didn’t see the +10% price appreciation we needed to make the 23x return in after hours trading. We may see some action from retail traders today that may bring the company's market cap closer to Apple, but as we said on Tuesday this was more of a small fun gamble position.

Today’s trade is another low odds trade at 10%, but the reasons for this one are quite different. We’re going to take a look at the market for Kanye launching a crypto coin in February. This market is interesting for many reasons and was priced at 75% just a few days ago. Let’s dig into what makes this trade intriguing to us.

For the past two weeks Kanye has been having a meltdown on X, and it looks like we might soon be witnessing the launch of Kanye West’s long-anticipated crypto coin. With only tomorrow left in the current window and polymarket odds sitting at 10%, we are looking at the possibility of a 10x return if the coin goes live in the next two days. Let’s break down why Ye might release this coin, what it means for his brand, and what risks and rewards come with betting on this 48-hour event.

The $YZY Memecoin

Multiple reports indicate that Kanye West—now often referred to as Ye—has been teasing the launch of his very own cryptocurrency, tentatively named $YZY. This token is rumored to serve as the official currency on his website, where fans could use it to purchase Yeezy merchandise. Although Kanye has previously dismissed crypto projects—claiming, for example, that “coins prey on fans with hype”—recent cryptic posts on X suggest a change in stance. Sources have reported that Kanye hinted at an imminent launch, even stating that all other available tokens were “fake.”

Centralized Allocation & Concerns

One major point of skepticism surrounds the token’s distribution model. Rumors claim that if $YZY is launched, Kanye might retain as much as 70% of the total supply. The remaining percentage would allegedly be split—with around 10% set aside for liquidity and 20% for investors. This highly centralized distribution is a red flag in the crypto world, as it mirrors previous celebrity-backed tokens that experienced dramatic pump-and-dump cycles. High concentration in one party’s hands not only limits the token’s decentralization but can also lead to market manipulation, leaving ordinary investors exposed to substantial risk.

Account Control & Scam Fears

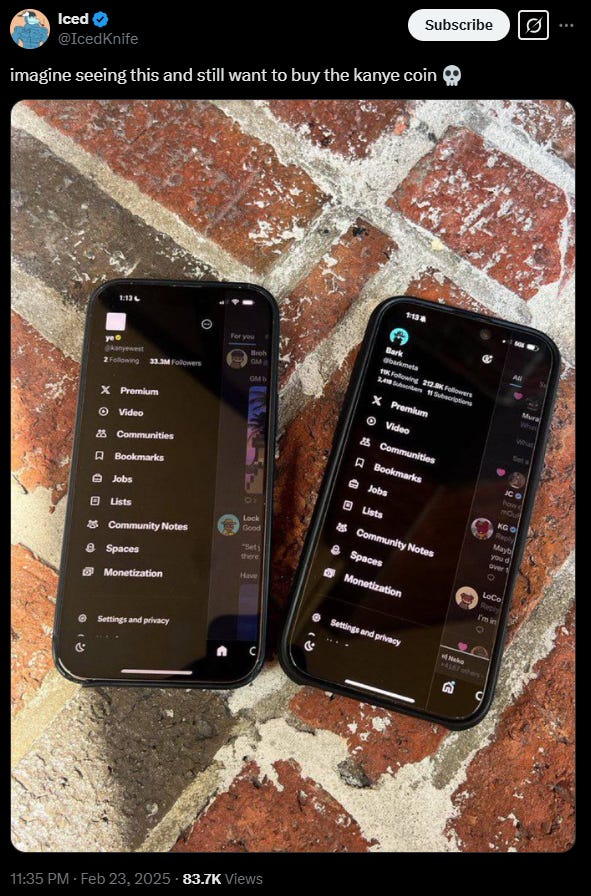

Adding another layer of controversy, there are persistent rumors suggesting that Kanye’s social media account on X may not be entirely under his control. Some insiders have speculated that Kanye may have sold or leased his account to a group linked with the meme coin community—most notably a group associated with the name Barkmeta—for around $17 million. Given Barkmeta’s history and previous involvement in dubious meme coin projects, this allegation has stoked fears that the promotion of $YZY might be part of a larger scam. Analysts have observed unusual changes in account activity and warned that if the account is being managed by third parties, any crypto promotion coming from it should be approached with extreme caution.

Platform and Blockchain Speculations

Early in the rumor mill, there were talks about Kanye launching his token on established blockchain platforms like Cardano. In fact, some reports even hinted at the possibility of him creating an entirely new blockchain tailored to his brand. However, these ideas were quickly squashed by prominent figures in the blockchain space. For example, Cardano founder Charles Hoskinson publicly dismissed any notion of Kanye launching a project on Cardano, emphasizing that serious blockchain projects require rigorous technical and operational standards—standards that celebrity ventures often struggle to meet. Other speculations included forking or adapting existing networks such as Solana or even leveraging the technology behind Dogecoin, but no definitive plans have emerged.

Controversial Branding

Perhaps the most sensational aspect of the rumors was the mention of a token with an extremely provocative name—“Swasticoin.” This name, laden with controversy, seems to align with Kanye’s long history of courting public outrage through provocative statements and imagery. While some believe this was nothing more than hyperbolic online banter or an ill-advised marketing stunt, it clearly reflects the chaotic nature of celebrity-driven crypto projects. The very idea of such a name raises significant questions about both the intent and the potential fallout, should the project ever materialize.

Polymarket Insider Trading

In addition to the speculative tokenomics and questionable account control, there is a large probability of insider trading on Polymarket in this specific market. We have noted the sudden appearance of numerous newly created accounts—accounts that have never placed any bets before, yet now hold tens of thousands of dollars solely on the outcome of Kanye launching a coin in February. We believe these accounts aren’t the work of casual bettors but rather the handiwork of insiders who are likely to be the same people orchestrating the takeover of Kanye’s social media presence. If these same players are behind the coin’s launch, it would be a strategic play to time the launch on Friday—the final day of February—when Polymarket prices will be at their lowest. This insider trading will allow them to profit not only from a potential surge in the coin’s value but also from betting on the coin's release on Polymarket.

Conclusion

Our analysis of this market points to a significant possibility of insider trading influencing the Polymarket odds. The sudden surge of newly created, high-stakes accounts betting on Kanye’s coin launch is a huge giveaway—these accounts are unlikely to be casual bettors. Instead, they appear to be strategically positioned by insiders who may have privileged information about the impending launch timing. This calculated move could allow them to capitalize on the low market prices expected on the final day of February, driving a massive upside when the coin goes live.

Given this context, I’m taking a small position on the yes side of this trade. Despite the inherent risks of betting on a celebrity-backed crypto project, the possibility of a 10x return makes this risk an attractive proposition—if these insider signals are correct, the reward far outweighs the downside. A modest allocation not only limits potential losses but also positions us to benefit significantly should the insiders’ strategy pay off.