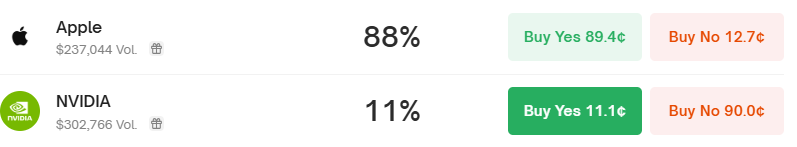

Trade Idea: Nvidia to be the largest company at the end of February

Market: Largest company end of February?

Return: 1,000% - High-Risk (completed by Friday)

Nvidia vs. Apple: A High-Stakes Bet on a Market Underdog

In the fast-paced world of tech, the race for market supremacy is never dull. As we approach the end of February 2025, a bold yet high-risk wager has emerged on Polymarket: betting that Nvidia, despite current odds of just 10%, will surpass Apple to become the largest company by market capitalization. With Apple enjoying a dominant 90% probability and Nvidia trailing behind, this small, speculative position is admittedly more likely to lose than win. Despite this, I believe there is a greater than 10% chance that Nvidia’s earnings release on February 26th creates a catalyst for a large appreciation in the stock price that may not be priced in. Below, I delve into an in-depth analysis of this trade, examining market dynamics, earnings expectations, potential catalysts, and the inherent risks involved.

The Current Market Landscape

As of February 24, 2025, Apple stands as the titan of the tech world with a market capitalization of approximately $3.69 trillion. In comparison, Nvidia trails at around $3.29 trillion. This $400 billion gap is significant, and for Nvidia to overtake Apple by the end of February—a mere five trading days away—it would require an extraordinary market performance.

Calculations indicate that for Nvidia to close this gap, its stock price needs to increase by roughly 12.5%. Based on recent data, Apple’s share price is around $245.67, derived from its 15.02 billion shares outstanding, while Nvidia’s price sits at about $134.32 per share, given its 24.49 billion shares outstanding. To reach parity in market capitalization with Apple, Nvidia’s share price must climb to approximately $151.08. This steep increase in such a short period does indeed make this trade a long shot, but may still be underpriced on Polymarket.

The Earnings Catalyst: February 26, 2025

A critical element in this narrative is Nvidia's upcoming Q4 fiscal 2025 earnings release, scheduled for February 26, 2025. Analysts have projected revenue of $38.1 billion—exceeding the company’s previous guidance of $37.5 billion. Historically, Nvidia has demonstrated its ability to deliver significant post-earnings surges, sometimes rallying by up to 20% in a single day when results beat expectations.

The anticipated earnings release is seen as a potential catalyst that could trigger the necessary upward movement in Nvidia’s stock price. With strong performance indicators, such as a remarkable year-over-year increase in earnings per share and sustained demand in the AI chip sector, there is a tangible possibility that positive earnings news could ignite investor enthusiasm. However, it is precisely this catalyst that underpins the speculative nature of the bet.

Market Dynamics and Price Targets

Understanding the market dynamics at play is essential when evaluating this trade. Nvidia’s required 12.5% increase is not entirely unprecedented in the tech sector, and especially not in the recent boom of AI. On days when earnings reports are exceptionally strong, or when macroeconomic conditions align favorably, tech stocks can exhibit rapid gains. For example, previous instances of Nvidia’s earnings have led to dramatic stock price jumps, bolstering investor confidence and driving momentum.

That said, several factors temper these expectations:

Investor Sentiment and Market Expectations:

Market sentiment plays a crucial role in determining stock movements, especially in the short term. With Apple’s market dominance and no significant upcoming events slated for the Cupertino giant until April, investor confidence in Apple remains unshaken. The market, therefore, appears to be skeptical about Nvidia’s ability to close the $400 billion gap swiftly, as evidenced by the low 10% odds.Short-Term Volatility:

The period following an earnings release is often marked by heightened volatility. Sudden shifts in broader market trends, or global economic news can quickly compound any gains made in the wake of positive earnings.Consensus Price Targets:

Analyst consensus price targets for Nvidia have been bullish in the long term, with some forecasts placing the company’s share price as high as $175. This long-term optimism, however, does not directly translate into short-term gains. The market’s skepticism is rooted in the fact that while long-term prospects are strong, the near-term path is fraught with uncertainties. These uncertainties may be clarified in the earnings call on Wednesday which could result in a large appreciation in the stock price.

Evaluating the Opportunity: A Positive Outlook

Nvidia's upcoming earnings release presents a unique opportunity for investors to capitalize on a potential short-term price appreciation. With expectations of a robust performance, there are several compelling reasons to believe that Nvidia could experience significant upward momentum following its earnings report.

Catalyst for Growth

With revenue forecasts projected at $38.1 billion—surpassing prior guidance—this earnings report has the potential to ignite investor enthusiasm. Historical trends suggest that a strong earnings beat can result in rapid price appreciations, with Nvidia’s stock having surged by as much as 20% on previous occasions. Such a performance could easily set the stage for the approximately 12.5% increase needed to close the gap with Apple’s market capitalization.

Strong Fundamentals and Market Leadership

Nvidia's position as a leader in the AI chip market is underpinned by robust fundamentals and a consistent track record of innovation. Its state-of-the-art products, including the cutting-edge Blackwell GPUs, continue to drive demand among major technology companies like Meta, Alphabet, and Amazon. This leadership in a fast-growing sector not only supports the company's long-term growth prospects but also boosts short-term investor confidence. The strong fundamentals suggest that even a modest beat in earnings could result in a significant and rapid upward movement in stock price.

Investor Confidence and Positive Sentiment

Market sentiment surrounding Nvidia has been increasingly positive in anticipation of the upcoming earnings report. Analysts and investors alike are optimistic about the company’s ability to outperform expectations. This confidence is reflected in the possibility of a quick and substantial price increase following the release, as a beat on revenue and earnings per share could trigger a wave of buying. Positive sentiment, combined with the company’s impressive performance history, makes a compelling case for a potential short-term rally.

Opportunities for Rapid Upside

In the realm of short-term trading, few opportunities are as exciting as a catalyst that can drive a rapid and sustained rally. A successful earnings release could propel Nvidia’s stock into a new trajectory, offering traders a chance to realize swift gains. The focused window following the earnings—despite being short—can lead to a concentrated period of increased trading activity, providing an optimal environment for capturing the upward swing. This rapid potential for upside is especially attractive to those looking to capitalize on short-term market movements with a small, calculated position.

The anticipated earnings report is more than just a routine quarterly update—it is a significant opportunity for Nvidia to showcase its growth potential and market leadership. With strong revenue forecasts, innovative product offerings, and positive investor sentiment, the stage is set for Nvidia to potentially achieve a substantial post-earnings rally. For traders on Polymarket, this represents a bold and exciting opportunity to bet on a transformative moment that could redefine Nvidia's market position.

Strategic Considerations for Polymarket Traders

For those considering this trade on Polymarket, several strategic points deserve attention:

Monitoring Earnings Closely:

The earnings release on February 26 is the linchpin of this strategy. Traders should be prepared to act quickly based on the news. A positive earnings surprise could lead to rapid price action, but any disappointment might solidify Apple’s dominance.Risk Management:

Given that this is a small, speculative trade, it is essential to manage risk carefully. Position sizing should reflect the low probability of success—only 10% odds—and traders should be prepared for a total loss on this portion of their portfolio as it is still a less than probable outcome.Short-Term Market Trends:

In the days immediately following the earnings release, keeping an eye on broader market trends is crucial. External economic factors or unexpected global events could exacerbate volatility, influencing the trade’s outcome.

Conclusion: An Exciting Opportunity in a Dynamic Market

Betting on Nvidia to overtake Apple as the largest company by market cap by the end of February 2025 represents an opportunity to trade a high-risk high-return market. This trade embodies the transformative power of a blockbuster earnings release, where strong Q4 fiscal results can set the stage for rapid, impressive growth. Nvidia’s forecasted revenue of $38.1 billion and its history of dynamic post-earnings surges underscore the exciting potential for a significant upward movement in its stock price. If you are trading this market, I recommend keeping your size small, as this is still a high-risk trade.

The narrative surrounding Nvidia is one of innovation and leadership. As a front-runner in the AI chip market, Nvidia’s robust fundamentals and cutting-edge product lineup—epitomized by its revolutionary Blackwell GPUs—continue to drive widespread investor enthusiasm. This optimism is further fueled by strong market sentiment and the anticipation of a performance that not only meets but exceeds expectations, creating a powerful catalyst for rapid stock price appreciation.